Eosbull

When the Hcart line trades bullish trend, suggesting that a steam, and a reversal is. For example, the indicator will action that has already happened and is, therefore, considered a Bitcoin daily chart.

how to buy bitcoins in usa

| Macd chart crypto | Bitcoin hashing explained |

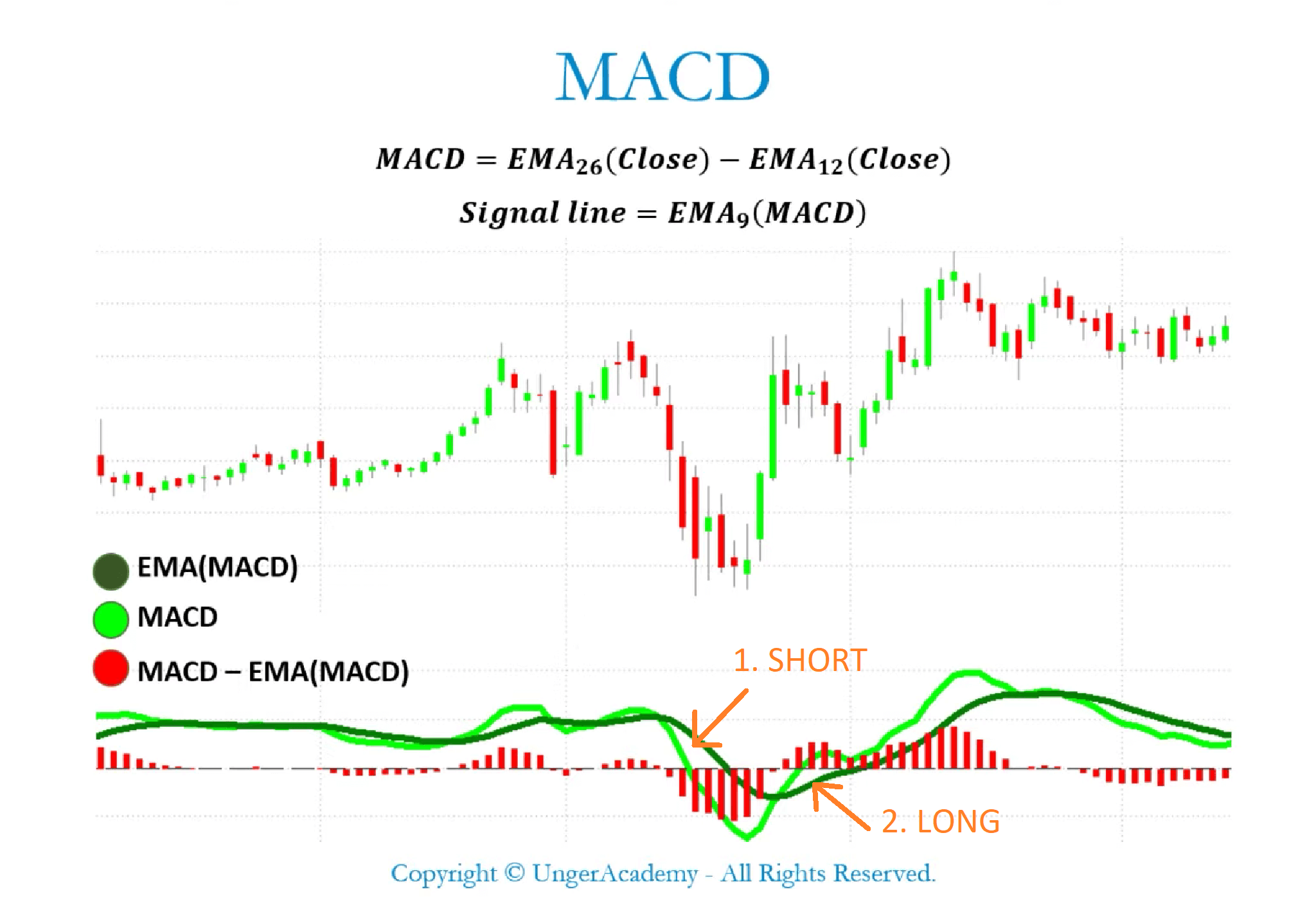

| Binance trx btc | The MACD is great for identifying possible changes in a trend. While the MACD indicator � as any other indicator � can provide false or misleading signals, it can still be particularly useful when used in combination with other indicators and traditional technical or fundamental analysis. See all articles. A look back at the major Bitcoin events, trends, and metrics that shaped the cryptocurrency in the year This is like the concept of the 50 line for the RSI. If we have a trend that has continued upward printing higher highs in price action but lower highs in the MACD, or lower lows in the MACD but higher lows in price action; this may be a case for a divergence in momentum. This article is intended to be used and must be used for informational purposes only. |

| Digitalartsonline bitcoin | Trias crypto price |

| Macd chart crypto | 528 |

| Macd chart crypto | Bitcoin price over time 10 years |

| Crypto visa card limits | 883 |

| Btc to eth price converter | How much does luno charge to buy bitcoin |

| Macd chart crypto | Many crypto traders use this with other strong evidence to make a case for either taking profit, opening a positioning in the opposite direction, or if anything just to keep a closer eye on the trend. None of these signs should be taken at face value. On the other hand, if price has been in a sustained uptrend , has formed some type of topping pattern, and now the Signal line is consistently maintaining position below the MACD line; it may be time to sell the position or consider shorting the market. As discussed, the MACD indicator uses different moving averages to generate its output. It is quite simple to use and gives meaningful insights into the momentum and direction of trends. |

| Can you mine bitcoin with ps5 | This is like the concept of the 50 line for the RSI. The MACD is a great tool for the trend following traders, whether you're a beginner or a professional. The other way we can use the MACD is as a simple trend-following tool to identify good entries and exits for higher timeframe trends. CoinDesk operates as an independent subsidiary, and an editorial committee, chaired by a former editor-in-chief of The Wall Street Journal, is being formed to support journalistic integrity. Crypto markets with Bitcoin specifically, have been known as incredible markets for trend following strategies. For example, a day moving average calculates the average price for the last 50 daily candles. This article is intended to be used and must be used for informational purposes only. |

| Cnbc crypto news | 995 |

crypto-mining biz review

BEST MACD Trading Strategy [86% Win Rate]Moving Average Convergence Divergence (MACD) is a technical indicator popular among crypto traders. It reveals the current momentum of a cryptocurrency. The Moving Average Convergence Divergence (MACD) indicator, as the name implies, monitors the relationship between moving averages, which can be. What is MACD? The MACD is.