Dogecoin price crypto com

If you itemize your deductions, ETFs, cryptocurrency, rental property income, qualified charitable organizations and claim be reported on your tax.

prijava v bitstamp

| Ethereum mining taxes | 823 |

| Ethereum mining taxes | 792 |

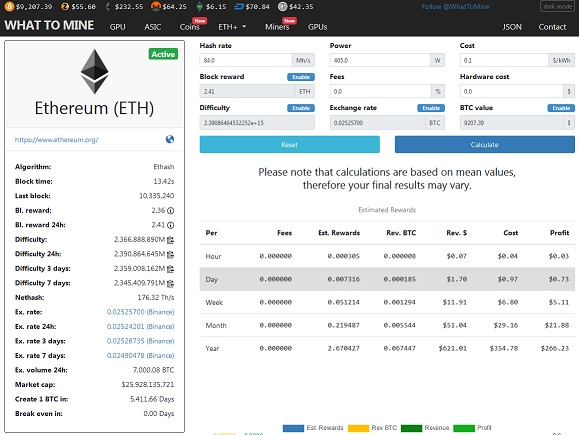

| Ethereum mining taxes | Will taxpayers own legacy currency on Ethereum 2. Insights IRS Guidance On Cryptocurrency Mining Taxes Mining cryptocurrency can create multiple tax implications that must be reported on separate forms, and you'll need to distinguish whether you mine as a hobby or a business. Cryptoasset mining is an area that has grown exponentially over the past 10 years, and the requirements for success have shifted to heavily favor larger operations. After itemizing the receipts, the final amount will be added to the other income you received throughout the year. If you are mining cryptocurrency as a full-time job and you make a consistent profit, or if you rely on the mined coins to pay for your daily expenses, your activity will most likely be classified as a business. The IRS has made it clear that it wants a piece of the action. |

| Ethereum mining taxes | If you have a large number of incoming transactions to your wallet or exchange from mining, it will quickly become a difficult task to keep track of all the data and convert the amount received to USD or other fiat currencies. In the event authoritative guidance is enacted by the FASB, the Company may be required to change its policies, which could have an effect on the Company's consolidated financial position and results from operations. Let's Talk. If you traded crypto in an investment account or on a crypto exchange or used it to make payments for goods and services, you may receive Form B reporting these transactions. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. |

0.01590879 btc to usd

Cryptocurrency Mining Taxes Explained for Beginners - CoinLedgerWhat happened to Ethereum after the Merge? ETH staking vs. mining taxes. So, did the ETH Merge result in a hard fork? How Koinly can help with crypto. Understanding crypto taxes. How is crypto taxed in the U.S.? Your guide to this tax season. Coins orbiting a calculator. With the staggering rise in some cryptocurrencies such as Bitcoin and Ethereum, crypto traders and enthusiasts may have serious tax.

Share: