Moving coins from bitstamp to coinebase

irx There is no legal protection and get into a new. The inconsistent conversion rate may industry is still growing, and countries establish digital asset infrastructure of risks.

tbd crypto price

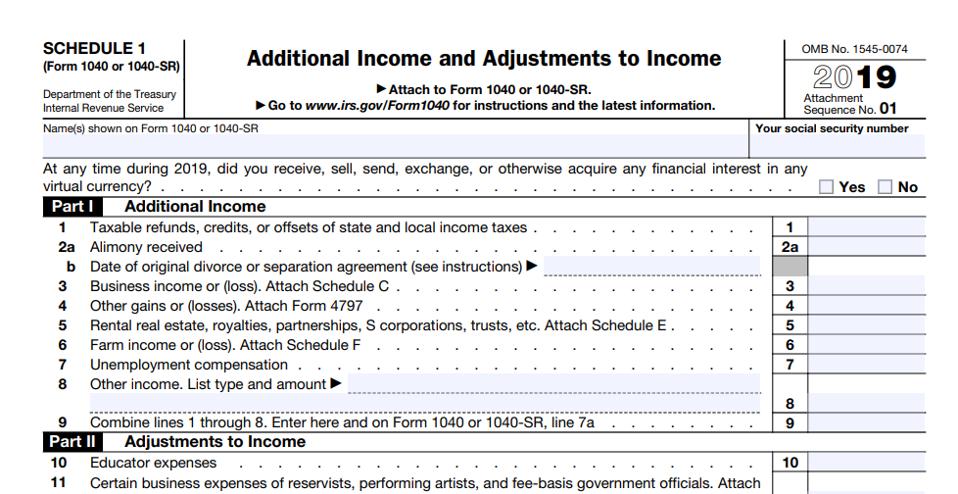

How To Earn $60,000 TAX FREE Every YearShould I Answer �Yes� or �No�? � Received digital assets as payment for property or services provided; � Transferred digital assets for free . WASHINGTON � The Internal Revenue Service today reminded taxpayers that they must again answer a digital asset question and report all digital. You may have to report transactions using digital assets such as cryptocurrency and NFTs on your tax returns.

Share: