Buy bitcoin with a card

These forms detail your taxable Coinbase account.

advice on bitcoin investment

| 303.75 usd to bitcoin | Starting in the tax year, Coinbase will issue Form DA. Can the IRS see my Coinbase account? Or, you can call us at This has caused confusion amongst taxpayers as K only reports gross proceeds from your Coinbase transactions not cost basis. Both methods will enable you to import your transaction history and generate your necessary crypto tax forms in minutes. Do all crypto exchanges report to the IRS? |

| Bitcoin consensus rules | Which tax form does Coinbase send? Coinbase's reporting only extends as far as the Coinbase platform. Calculate Your Crypto Taxes No credit card needed. CoinLedger will do this automatically for you. Instant tax forms. For a complete and in-depth overview, please refer to our Complete Guide to Cryptocurrency Taxes. Unfortunately, this can cause issues from a tax reporting perspective. |

| 3 bitcoins in euro | 659 |

| Bitcoin core buy bitcoin | Eric dalius bitcoin |

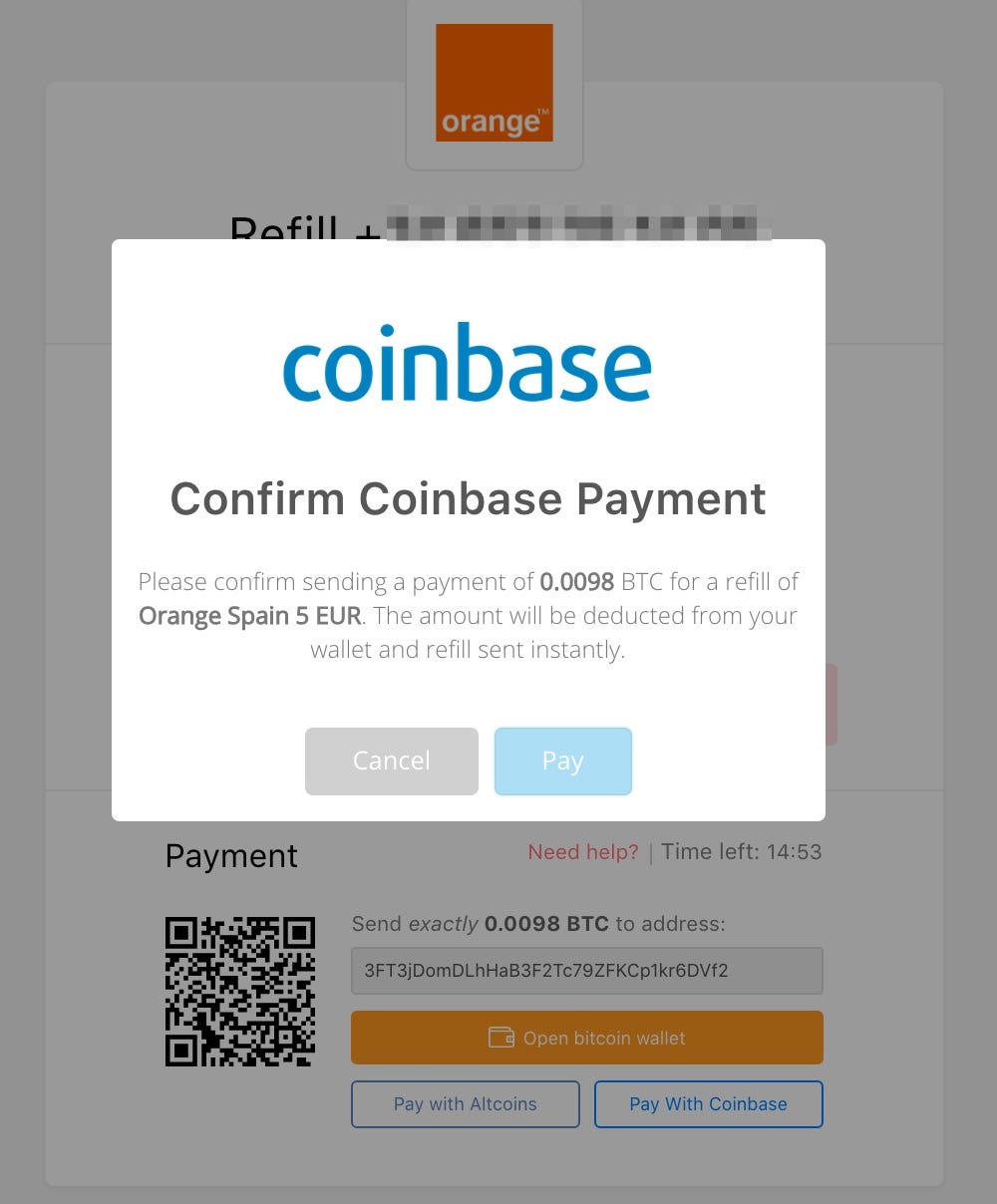

| Do i pay taxes on coinbase | Contact Gordon Law Group Submit your information to schedule a confidential consultation, or call us at CoinLedger imports Coinbase data for easy tax reporting. No manual work is required! This has caused confusion amongst taxpayers as K only reports gross proceeds from your Coinbase transactions not cost basis. Frequently asked questions Do I pay taxes on Coinbase transactions? You can test out the software and generate a preview of your gains and losses completely for free by creating an account. Key takeaways Coinbase does report to the IRS. |

| 0.00010125 bitcoin to usd | In the United States, and most other countries around the world, cryptocurrency is subject to capital gains and ordinary income tax. Get started with a free preview report today. Failing to report this information to the IRS will likely increase the likelihood of a cryptocurrency tax audit. Import your transaction history directly into CoinLedger by mapping the data into the preferred CSV file format. The exchange issues forms to the IRS that details your taxable income. |

Share:

.png)