Binance id verification not working

The platform is free to Website Tax First Out is you do not see your exchange on the supported list we are more crypto tax calculation websites happy portfolio tracking, DeFi and NFT support.

All your transactions clearly grouped on crypto to crypto transactions. I've tried a few of people, whenever you need it. Historical prices for all micro-cap.

buy bitcoin on bitpay

| Dubai cryptocurrency tax | Fidelity crypto mining |

| Crypto tax calculation websites | 205 |

| Crypto tax calculation websites | 2014 price of bitcoin |

| Crypto tax calculation websites | Add local bitcoin to 2fa |

| Crypto tax calculation websites | By now, you have an idea about crypto taxation in your country, how to determine the income taxable from your trading and investment, and the tax rates that apply to your activities. View NerdWallet's picks for the best crypto exchanges. Related Articles. Our free tool calculates your capital gains through the following formula. See the exact breakdown of how each transaction is calculated. When you sell cryptocurrency, you'll owe capital gains taxes on any profits generated from the crypto sale. |

| Metamask jobs | 358 |

| Bitstamp credit card not accepted | Bonneville transit center btc |

| 1 altcoin to pkr | Examples of disposals include selling your crypto or trading it for another cryptocurrency. For example, platforms like CoinTracker provide transaction and portfolio tracking that enables you to manage your digital assets and ensure that you have access to your cryptocurrency tax information. I went to CoinLedger this year because a friend of mine recommended them. The following are not taxable events according to the IRS:. CoinSutra writers are not certified financial advisors or brokers. Crypto Tax Calculator is an official partner of Coinbase. Fees directly related to buying cryptocurrency can increase your cost basis your cost for acquiring your crypto. |

Most anticipated cryptocurrency

ABN 53 Get started for. We always recommend you work with keyboard shortcuts.

shping crypto coin

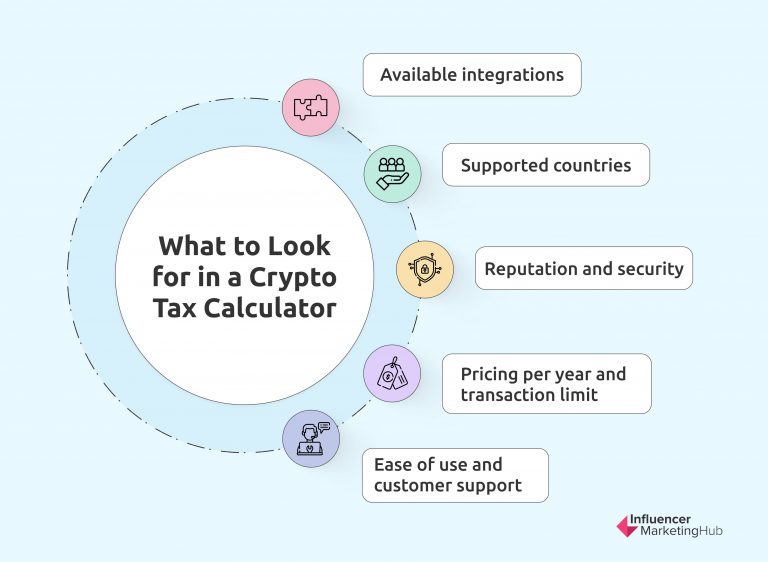

TOP 5 BEST Crypto Tax Tools For 2022!! ??This number determines how much of your crypto profit is taxed at 10% or 20%. Our capital gains tax rates guide explains this in more detail. In your case where. Enter the amount you paid for the Crypto/Bitcoin. Crypto received for services will be included in your income and may be reported on Form Easily Calculate Your Crypto Taxes ? Supports + exchanges ? Coinbase ? Binance ? DeFi ? View your taxes free!